Wall Street is no longer a roller coaster, it’s a runaway train heading over a cliff.

How are you feeling about losing at least a fifth of your retirement savings? Or thousands you diligently tucked away for your kids’ education? Your investment adviser is no doubt telling you to stay the course, think long term, ignore the fluctuations, remember the market always comes roaring back. But things could also get worse. Much worse.

Less than two months ago, in late February, the S&P 500 index hit its highest level ever—3,393. Within the next four weeks, the rapid spread of the COVID-19 sank the index to 2,192. Today, Wall Street believes we are in a recovery, and the index has crept back up to 2,766. That, however, still represents nearly a 20 percent decline from the peak.

But here’s what the market has not factored in. Earlier this week, the International Monetary Fund pronounced the odds of the global economy growing at all in 2020 as “negligible,” and global GDP could contract more than 7%. That assumes, however, that the worst of the virus is over in a couple of months. Suppose economies cannot fully reopen until a proven vaccine is available in 18 months? Suppose foolish governors reopen their economies prematurely, casualties spike, and even more of the U.S. economy must be shut down? Suppose the virus come roaring back in China and massively afflicts Brazil (where president Bolsonaro is in full denial of the pandemic)? Suppose the virus mutates in different ways, as some scientists are reporting, and no single vaccine is possible? A deeper, longer global economic collapse could have harrowing implications for the stock market.

But there is an alternative. It’s simple and right in front of us. Consider investing in the local businesses you love that will be desperate for cash in the coming months. Invest in great local projects your city will initiate—perhaps in energy efficiency or local food systems—that will increase your local resilience. Invest in the people around you who need assistance, like your kids who need help getting out of student debt. Invest in getting yourself out of credit card debt. In the coming months, I will be blogging a lot about specific local investment alternatives that make sense.

The federal stimulus package contains an interesting provision that allows American families afflicted with COVID-19 to take a short-term “hardship withdrawal” from their pension funds. You can also do so if you are adversely affected by a quarantine, layoff, reduced hours, or increased child care expenses—in short, just about everyone qualifies. There are no penalties—you just have to pay yourself back in three years at a small interest rate (and your fund keeps the interest). You can borrow up to the lesser of 100% of your pension or $100,000. This is a perfect occasion to get started with investing locally, including in yourself.

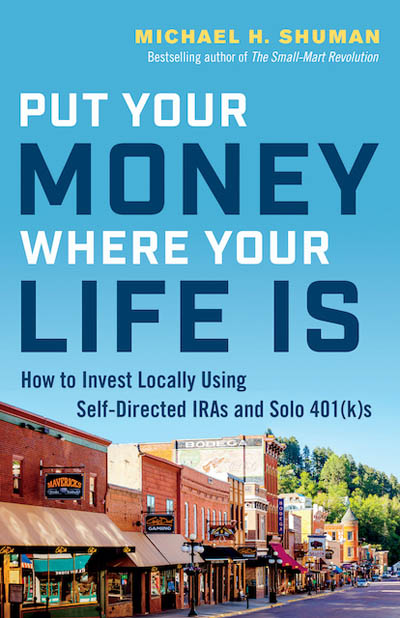

Even if you don’t qualify for this option, you still can effectively do the same thing with a Solo 401k (though you’re limited to $50,000). That’s the subject of my new book, Put Your Money Where Your Life Is: How to Invest Locally Using Self-Directed IRAs and Solo 401ks. The book is on my mind because the first batch of 200 just arrived on my doorstep yesterday, like Baby Moses in the straw basket.

So, friends, enough despair. Here are three very specific steps you can take to begin weaning yourself and your future away from the Wall Street terror train.

(1) Commit – Take a solemn vow to take some percentage of your pension savings—at least 1%—and reinvest that money locally.

(2) Learn – Educate yourself about how exactly you can invest your pension funds locally—including where are the best places to invest, how to evaluate companies, what are the legal issues to consider. You can do this by reading Put Your Money Where Your Life Is. It’s technically not out until June, but you can order copies starting today online. When your local bookstores reopen, please get your friends to buy copies there.

(3) Organize—If you think others in your community should be investing alongside you, let’s work together to organize an all-day workshop. Under the auspices of Neighborhood Associates Corporation, we develop a game plan for revitalizing your businesses and yourselves. I’d love it to do this workshop in person, but who knows what the rules on travel will be in the next few months. At a minimum I’m prepared to beam into your community virtually for a day. If you’re interested in getting details about what the workshop would look like, please e-mail me immediately at shuman@igc.org. Put “WORKSHOP DETAILS” in the Subject line.

A once-in-a-lifetime crisis often begets a once-in-a-lifetime opportunity. And there’s no better time to put your money to work in your own backyard than today.