(This blog is part of a 12-part series on emerging opportunities for local investment that are especially important in the post-COVID era. It’s drawn from my new book, Put Your Money Where Your Life Is.)

—–

In my last blog, I argued that if you have any significant savings to invest (say $50,000 or more), becoming a homeowner will almost always generate a better rate of return than Wall Street. I now want to extend this argument to paying down your mortgage faster.

Suppose you already have a mortgage, you have no credit card debt, and you have extra money to invest. Might it make sense to invest those dollars in Wall Street? Probably not. Because under most reasonable assumptions, you will get a higher return if you use that money to pay down your mortgage more quickly. Again, the tax advantages of your home, even with a smaller mortgage, will beat your long-term gains from Wall Street.

In my last blog, I showed two ways you could invest $50,000. You could remain a renter and use the $50,000 to become a Wall Street tycoon, in which case you’d enjoy a 5% rate of return from the stock market over 30 years. Or you could use the money as a 20% downpayment on a 30-year mortgage at 5%. To make the case convincing, I assumed that the house would not appreciate a penny. You could pay $1,073 per month on rent, or $1,073 per month on your mortgage.

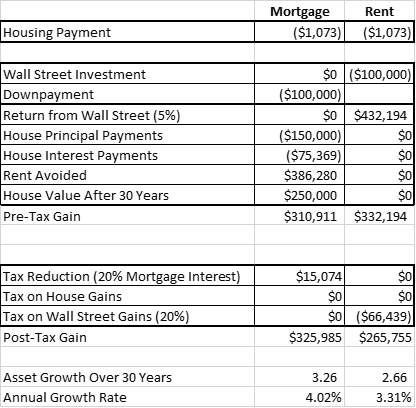

Let’s assume everything above is true, but you have $100,000 up front instead of $50,000. In the homeowner scenario, rather than put 20% down, you put 40% down. With the same mortgage payment, you will be able to pay off the property in 17 and a half years instead of 30. The alternative is to rent and put the $100,000 into Wall Street.

The table below shows what happens over 30 years. Again, your 30-year gain as a homeowner still beats your Wall Street gain. Notice that as a Wall Street investor, you’re rate of return stays constant, because we assume the annual return on stocks (5%) and your marginal tax rate (20%) stay the same. As a homeowner, however, your rate of return declines slightly as you borrow less from the bank, because you are losing the tax advantages from the mortgage interest deduction. You still do better than Wall Street, but it’s a closer case.

Renting Tycoon vs. Aggressive Mortgage Payer (Over 30 Years)

If you continue down this road and pay more and more up front, the tax advantages of the mortgage interest deduction ultimately disappear, and then the Wall Street investment finally looks more attractive.

But suppose your house appreciates 2% per year above inflation. That’s what Professor Robert Shiller of Yale calculates as the average gain of U.S. houses in recent history. If that holds true, paying off your mortgage more quickly will almost always be a better bet than Wall Street. The table below assumes you put 80% down. If you house appreciates a 2% per year, you’ll still beat Wall Street.

Renting Tycoon vs. Super-Aggressive Mortgage Payer (Over 30 Years)

Like any models, the examples above simplify reality. Chances are good that you will have extra money later in the mortgage, rather than early on. But the lessons from these models will still hold. If you’re risk averse, using that money to pay the mortgage faster will enable you to own your home, free and clear, faster. That’s an incredibly important safety net for the rest of your life. If you need cash later, you can sell your home for something smaller, or you can take out a reverse mortgage.

Again, unlike Wall Street, your home is a local investment you can control. If you take care of your investment, maybe even upgrade a little here and there, you can help the asset appreciate. With Wall Street, all you can do is pray.

For tens of millions of Americans, the only wealth they will know will be their homes. Especially for them, focusing on the mission of becoming a homeowner faster is a more reliable way to build wealth, personally and locally, than sending money to distant companies.