(This blog is part of a 12-part series on opportunities for local investment that are especially important in the post-COVID era. It’s drawn from my new book, Put Your Money Where Your Life Is.)

The COVID economy is riddled with bad news, but there is one bright spot: Interest rates are at a historic low. This week The Wall Street Journal had the following headline on the front page: “Mortgages Soar on Low Rates.” The article reports that between April and June, during prime pandemic time, lenders had issued more than a trillion dollars in new home loans.

If you want to become a local investor and are currently a renter, this is a once-in-a-lifetime opportunity to grow your wealth. It also will strengthen your community, because studies show that homeowners, with much deeper roots than renters, are better stewards of real property, participate more in civic affairs, and act more mindfully toward their neighbors.

For tens of millions of Americans, their house also will be the only wealth they have for retirement. By the end of 2018, Americans had $113 trillion in gross assets, of which $26 trillion was in housing. Nearly one in four asset dollars are therefore in housing, and this ratio increases as household income get smaller.

Let’s perform a thought experiment: Suppose you have $50,000 in savings, and you’re wondering whether to invest it in Wall Street. You also are very disciplined with your own personal spending and have decided that you have about $1,000 to spend each month on your housing. You can put $50,000 in Wall Street and rent a place to live, or you can use that money as a 20% down payment on a $250,000 home with a 30-year mortgage. Put simply, you can pay $1,000 in rent and be a stock-market mini-tycoon, or just pay $1,000 in mortgage, acquire a home, and skip the stock market. Which should you do?

To run the numbers, we need to make a few simplifying assumptions. Let’s assume you find an interest rate of 5% for your mortgage. (This is conservative, because today you can get a 30-year JUMBO at 3.6% with a strong credit rating.) To make the case for being a stock-market tycoon especially strong, let’s also assume that over thirty years your property does not appreciate a penny. And finally let’s assume that Wall Street delivers a steady 5% return each year on your investment.

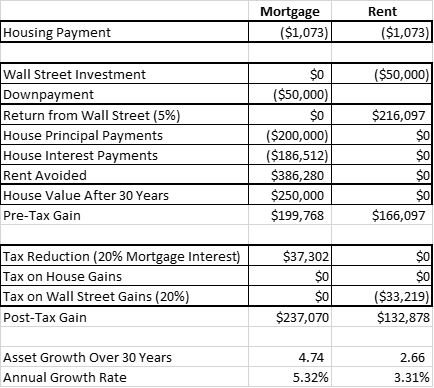

The table below shows what happens over 30 years. Under the scenario where you remain a renter and invest in Wall Street, your $50,000 investment grows impressively to $166,000. When you cash out in year 30, however, you need to pay ordinary taxes. If your marginal tax rate is 20%, you have netted about $133,000. Put another way, taxes reduce your annual Wall Street return from 5% to 3.3%, which is an inconvenient fact most of us forget about.

Investing in Wall Street vs. Investing in A Home (30 Years)

If you invest the same $50,000 in your own mortgage for 30 years, the most important gain is that you avoid $386,000 of rent. Rather than enrich a landlord each month, you grow your own personal wealth. In all, your avoided rent is more than double the interest you would pay on your mortgage ($186,000). Plus, you get an income tax deduction for the interest you paid on the mortgage. If you sold the house after year 30, moreover, you would owe no taxes on up to $250,000 of gains ($500,000 for a couple)—but, again, we assume zero appreciation of your house. Even with that very demanding assumption, your bottom-line gain would be $237,000—or an annual return of about 5.3%, which significantly beats what you would have earned from Wall Street.

Here’s another bonus: There are ways you can use your pension fund to take advantage of this opportunity. If you have a solo 401k, you can give yourself a five-year, $50,000 loan for the downpayment.

You can, of course, manipulate the assumptions above so that being a renter and investing in Wall Street makes more sense. If you live in a locality that taxes property heavily, you might prefer the stock market—though you’ll pay those taxes indirectly in the form of less house for your rental dollar. If your house loses value over 30 years—perhaps a toxic waste dump is suddenly discovered in the backyard—you’ll be better off renting.

But most of us assume, quite reasonably, that our houses will gain value, which makes the case for investing in your own home stronger. In fact, Yale economist Robert Shiller, the guru on housing price trends, suggests that historically the real estate market gains about 2% per year above inflation. If that holds true, paying off your mortgage more quickly will almost always be a better bet than Wall Street.

Having shared this simple analysis with lots of smart people, the best counterargument I’ve encountered is that in addition to property taxes homeowners must pay numerous fees for “operations and maintenance” (O&M): insurance, lawn mowing, pest control, repairs, etc. What this argument overlooks, however, is that many of these costs fall on renters anyway. Plus, many mutual fund investors face a 1% O&M cost every year (check the fine print on fees). Most importantly, every dollar you put into “O&M” not only maintains the value of your investment but also can increase the value of your home. Rather than leave your financial future to the invisible claws of the stock market, you can take control of your financial future by nurturing your biggest asset. All locally.

If you want to maximize the benefits of becoming a homeowner for your community, be sure to obtain your mortgage at a community bank or credit union rather than a banking behemoth. Keeping your interest payments local enables your bank to make more loans to local businesses. However, many banks, even local ones, short-circuit this multiplier effect by reselling the loans to bigger banks. As you shop around for a mortgage, one of your questions should be whether yours will be sold on the secondary market. If the answer is “no,” you can be sure your interest payments are going back into your community.

I’ll concede that not every American can afford a home. Unless your credit rating is defective, however, you probably have more ability to do this than you think. True, not every American can afford a split-level with four bedrooms and an acre of lawn. If you have more limited means, the goal is to find a more modest property that fits your financial profile. You might look for a small unit in a co-op building, a co-housing community, or a land trust. Only if you have no savings for a down payment is becoming a homeowner difficult (though not impossible), but in that case you would not have funds to invest in Wall Street anyway.

Here’s the bottom line: If you have money to invest, it’s almost always better to invest in your own home than Wall Street. This simple act strengthens your own finances and strengthens your community.

2 Responses

Kathy,

Thanks for your question. Since we live in the same place, I know well the high rents that you face.

Broadly speaking, I’d encourage you to find a place to (1) create a solo 401k after selling some things on eBay (which will give you reportable income on Schedule C, (2) move whatever your retirement savings have have into that account, (3) give yourself a low-interest loan for a downpayment on a right-sized small house or coop unit (maybe head north 10 miles), (4) build equity rather than pay rent, and (5) at some later age cash out your equity by selling and entering a reverse mortgage.

Hi, Michael:

Very interesting piece. One question: what if you did the stock market thing and now find yourselves 65 and 70 years old, retired and paying high rent in SilverSpring? I think we did it all wrong! Good luck with your book.

Kathy Parrent